ORDER TYPER: MARKET ORDER, LIMIT ORDER AND STOP ORDER?

There are various order types in trading that help you to execute your trades effectively and purposefully. The three most important order types you should know are market orders, limit orders and stop orders. Each of these order types has its own advantages and disadvantages, which you need to understand in order to manage your trading in the best possible way. In this article, we explain the differences and use cases of these three important order types.

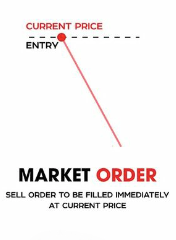

1. WHAT IS A MARKET ORDER?

A market order is an order where you buy or sell a financial instrument immediately at the best available price. With a market order, you instruct the broker to execute the trade as quickly as possible at the prices currently available on the market.

Example:

Assuming the current price of a currency pair is 1.2000. If you place a market order, your position will be executed at this price or the next best available price.

Features of the market order:

- It is executed immediately if there is sufficient liquidity. ⚡

- Ideal if you need fast execution.

- The disadvantage is that the price can also deviate slightly in the event of strong market fluctuations (slippage). 🚨

When to use it?

A market order is ideal for short-term trading or rapid market movements when you don’t have time to wait for a specific price.

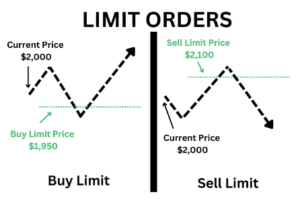

2. WHAT IS A LIMIT ORDER?

A limit order is an order in which you specify a certain price at which you want to buy or sell. In contrast to a market order, a limit order is only executed if the market reaches or exceeds the price you have specified.

Example:

Suppose you want to buy a currency pair at a price of 1.1800. You enter a limit order at this price. The order will only be executed if the price reaches 1.1800 or lower.

Features of the limit order:

- It guarantees the price, but not the execution.

- The order is only executed if the market reaches the specified price.

- The disadvantage is that the order may never be executed if the market price does not reach this point. ⚠️

When to use?

Limit orders are ideal for long-term trading or when you want a specific entry price without immediately entering the market.

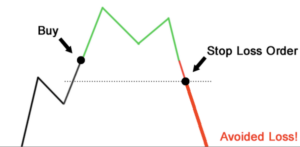

3. WHAT IS A STOP ORDER?

A stop order (also called a stop-loss order) is used to limit losses or secure profits by automatically executing when the price reaches a specified level. It can also be utilized as a stop-loss to close a position if the market moves against you.

Example:

Suppose you buy a currency pair at 1.2000 and set a stop-loss order at 1.1900. If the price reaches or falls below 1.1900, the stop order will automatically execute, and your position will be closed.

Features of a Stop Order:

- It is only executed when the price reaches a specified level.

- Stop orders can be used to limit losses or secure profits.

- They provide protection against losses when the market moves in the wrong direction. 🔒

When to Use?

A stop order is particularly useful for managing your risk and limiting losses if the market moves against you.

4. WHAT IS A TRAILING STOP ORDER?

A trailing stop order is a specialized type of stop order that automatically adjusts the stop price as the market price moves in your favor. This allows you to secure your gains while benefiting from potential further market movement.

Example:

Imagine setting a trailing stop of 50 pips for a currency pair. If the price rises by 50 pips, your stop price will automatically adjust upward. However, if the price falls, the stop will remain at the new level to limit your risk.

Features of a Trailing Stop Order:

- It helps you lock in profits while benefiting from market movements. 📈

- The stop price adjusts automatically in real-time.

- Ideal for swing and position trading when you aim to benefit from long-term trends.

5. CONCLUSION: WHICH ORDER TYPE IS RIGHT FOR YOU?

The choice of order type depends on your trading strategy and market conditions. While market orders are great for quick trades and reacting to immediate market movements, limit orders are essential for precise entries and long-term planning. Stop orders protect you from significant losses, and trailing stop orders allow you to maximize your profits.

Tip: Understanding all three order types and combining them as needed can help you minimize risk and make the most of market movements.

You are now just one step away from taking your trading to the next level!

The information you’ve received here is just the beginning. Would you like to know how you can use it for yourself and what other secrets will lead you to successful trades?

There’s a lot more we can share with you – but only if you take the next step. Write to us now directly via our Telegram support account and we’ll show you how to deepen your knowledge and achieve your first successes.